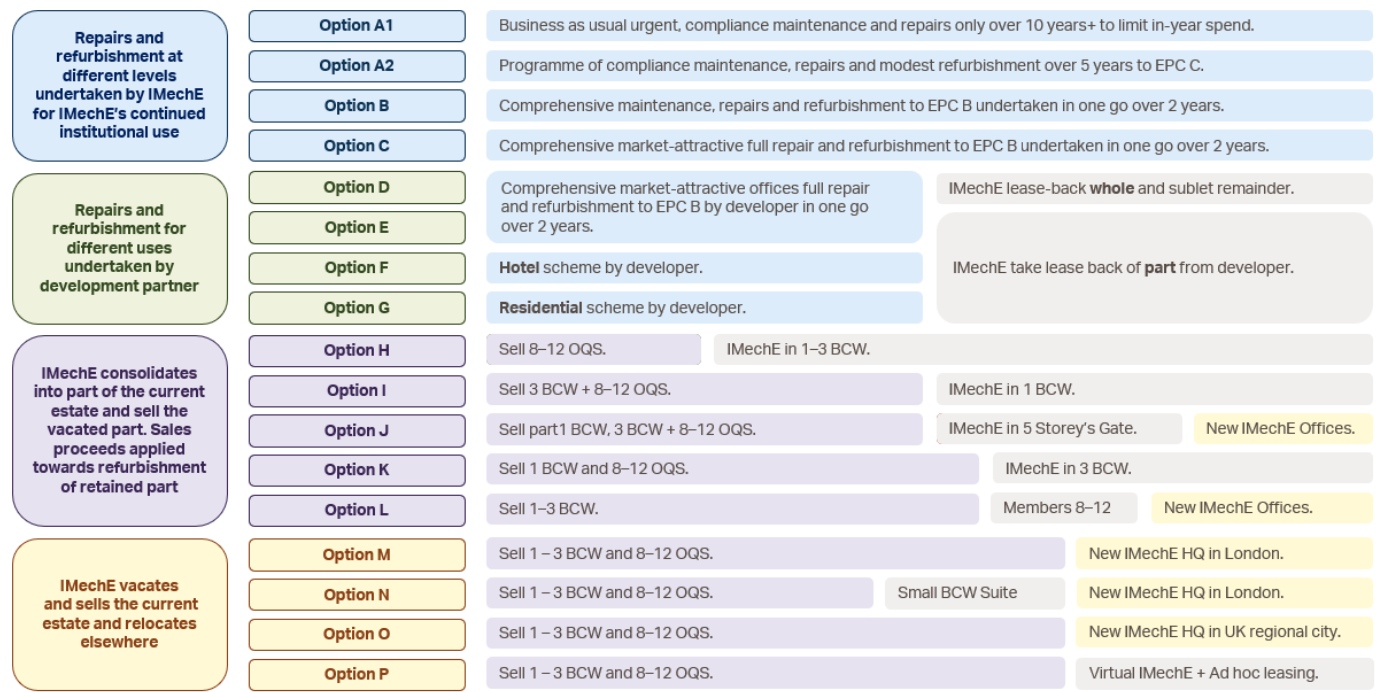

Repair and Refurbish (Blue)

These options involve the Institution retaining the estate and carrying out repairs and refurbishment directly, either all at once or phased over time.

Partner with a Developer (Green)

This approach involves entering into a partnership with a developer to convert part or all of the estate, potentially into a hotel, office, or residential scheme. The Institution could lease back space. Options vary in scale and structure, with both freehold and leasehold models assessed.

Sell Part of the Estate (Purple)

These options involve selling off part of the estate, such as 3 Birdcage Walk or 8–12 Old Queen Street, while retaining and operating from the remaining space.

Sell the Whole Estate (Yellow)

These scenarios involve a full disposal of the Birdcage Walk estate, with the Institution relocating to a new site in London, elsewhere in the UK, or shifting to a largely virtual model.

Option B – Refurbishment by the Institution

An option where the Institution funds and manages a full refurbishment itself. This would likely rely on charitable reserves and/or borrowing and/or fundraising.

Option F – Partnership with Hotel Scheme

A developer converts part or all the site into a hotel, with the Institution leasing back space. While viable, concerns have been raised about long-term control and compatibility with hotel design models.

Option I – Part-sale with Retained Title and Occupation

The Institution sells part of the estate but retains full legal control over the part it continues to occupy. This option provides stability, clarity of title, and continuity at Birdcage Walk.

Option J – Variant of I with Partial Relocation

Similar to Option I, but with less space retained, requiring partial relocation of staff. It involves a “flying freehold” arrangement, which could introduce legal complexity.

Option M – Full Relocation within London

A complete relocation to a new site in London, through purchase or lease. This offers the opportunity to create a fit-for-purpose space aligned with future needs.