Articles

Difficulty finding skilled employees is the biggest challenge facing engineering companies, according to an exclusive Professional Engineering survey of more than 200 engineers on the state of the industry. More than 40% of respondents across a wide range of sectors cited skills shortages as the single biggest issue facing their industry, with Brexit a distant second.

Of course, you can’t ignore the link between a Brexit-induced drop in migration and the ensuing shortfall in skilled engineers becoming available for UK companies. “Brexit will highlight the lack of homegrown engineering personnel, particularly the more skilled and university-educated ones,” wrote one survey respondent.

In all, more than 230 people responded to our survey on the state of engineering in a turbulent time for the profession. Although concerns over skills are weighing heavily, and some are slow to adopt digital technologies and implement Industry 4.0, there are reasons for optimism too.

Brexit uncertainty

By the time you read this, the UK will either be entering a transition period or an extension of Article 50, or on the verge of leaving the European Union without a deal. Engineers polled in mid-February expected a damaging effect on their businesses, with 58% predicting a negative impact in the next 12 months. Only 4% thought Brexit would be positive in the short term.

Longer term, the outlook is equally grim. Although one in five believes Brexit will have a positive long-term impact on their business, twice as many engineers think the UK leaving the EU will have a negative effect over extended timescales. And, despite 73% of respondents working for companies that export, fewer than half said their companies have a Brexit contingency plan in place – a quarter did not, and 30% didn’t know.

Industry 4.0

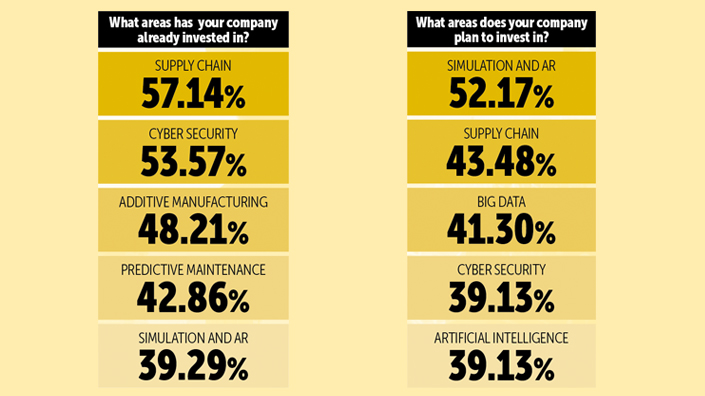

Despite the hype around the fourth Industrial Revolution, only 13% of the respondents work for companies that have already implemented Industry 4.0. One in 10 was working on a strategy, but only 3% planned to implement Industry 4.0 in the next 12 months. Respondents cited various reasons, including economic uncertainty and lack of investment. But the biggest thing holding back implementation of Industry 4.0 was simply a lack of understanding, according to 61% of respondents.

Skills shortages

As already mentioned, skills shortages were cited as the biggest challenge facing the industry by 41% of respondents. Four out of five said they had found it difficult or very difficult to find skilled people to fill vacancies over the past 12 months.

We were keen to explore the reasons, and there was one resounding answer – a lack of skilled people to fill particular roles, which was cited by 63% of respondents as the biggest barrier to recruiting new talent. One in five said an inability to compete on salary was the biggest problem.

Perhaps as a result of these challenges, only 20% of respondents were planning to increase the size of their workforce over the next 12 months, although 43% said their firms were planning to take on apprentices.

Company performance

Our respondents were broadly happy with how their companies had performed in 2018. One in five said their companies performed better or much better than expected, while 56% said performance was as they had predicted.

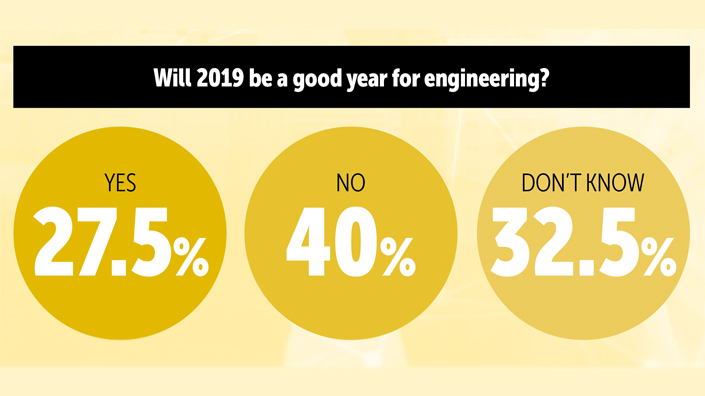

The outlook for 2019 was mixed – 37% were optimistic or very optimistic about growth in their sector for the next 12 months. But less than 30% of respondents thought 2019 would be a good year for engineering, with many citing Brexit as the reason why.

“Brexit may force the realisation that the only way in which the country can progress is through adding value by manufacturing rather than simply moving money around through financial services,” wrote one engineer.

“There is a lot of engineering talent in the UK – we just need to convince the government that it is worth investing in.”

Automotive in trouble

There were clear notes of concern for particular industries – particularly the automotive sector, which was hit by a wave of factory closure announcements in February. Three quarters of respondents said the outlook for automotive over the next 12 months was poor or very poor.

Biomedical engineering (55% good or very good) and the power and energy sectors (43%) had the most positive outlooks.

Content published by Professional Engineering does not necessarily represent the views of the Institution of Mechanical Engineers.