Three decades later the Vindeby windfarm has gone, decommissioned after 25 years for cost reasons, but it had shown the world that offshore wind was a feasible source of energy.

By 2020 the world had 35.3 gigawatts (GW, thousands of megawatts) of offshore wind capacity, according to the Global Wind Energy Council, a huge expansion driven by massive investment and improving technology. Almost a third of that (10.4GW) was installed around the UK.

The past decade has seen a particularly rapid rise helped by government incentives for industry, says Professor Simon Hogg, head of engineering at Durham University. “The cost of fixed-bottom offshore wind has come down more dramatically than anybody imagined would happen,” he says.

Then, on 17 January 2022, an announcement came that could alter the course of the flourishing industry. Crown Estate Scotland approved leases for 17 offshore wind projects, covering just over 7,000km2 of the seabed and representing 25GW of new capacity – two-and-a-half times the UK’s entire current capacity, and roughly equivalent to all the operational projects in Europe.

Industry experts, who had been expecting roughly 10GW of new capacity, were taken aback. But the giant capacity was only one of the big stories. The other was that floating turbines would account for roughly 15GW, providing about two-thirds of the new capacity.

“We were all surprised by the scale,” says Barnaby Wharton, director of future electricity systems at trade organisation RenewableUK. “At the moment, floating is a tiny proportion of the offshore wind market. We’ve got just a couple of projects operational, and those are only a few dozen megawatts each. But these projects will get to multi-gigawatt scale pretty quickly.”

Described by Wharton’s colleague Melanie Onn as “one of the country’s biggest ever steps towards net zero,” the ScotWind leases represent the most transformative change to the UK’s energy supply in decades. Over the next 10 years, the projects will transform a niche technology into a major supplier of zero-carbon energy – and the UK’s head start could prove extremely valuable as the rest of the world tries to catch up.

Off the shelf

Fixed-bottom turbines, which currently dominate the market, are limited to water depths of about 70m. This is a key reason for the UK’s lead – there are large areas of suitably shallow water in the North Sea – and explains why many countries are yet to follow.

Floating turbines could change that. As Wharton says, “the vast majority of offshore wind capacity, or potential offshore wind capacity, is floating”.

Installed on floating platforms in water up to hundreds of metres deep, the breakthrough new technology could open up “huge swathes” of seabed, says Wharton, allowing countries sitting on steep continental shelves – Japan, for example – to exploit the available wind resource. Farms can be placed further from land, accessing higher wind speeds and therefore higher yields. They could also enable simpler installation than fixed-bottom turbines, and less noise pollution to the surrounding environment.

Demonstrator projects have started to prove the technology. Norwegian firm Equinor opened Hywind Scotland, the first full-scale floating offshore windfarm, off the coast of Aberdeenshire in 2017. Its five turbines offer 6MW capacity each.

Components are transported before installation in the Hywind Tampen windfarm (Credit: Jan Arne Wold, Equinor)

Then in October 2021, the Kincardine offshore windfarm opened just down the coast, offering 50MW from six turbines to become the largest operational floating windfarm.

A month later, DP Energy revealed plans for a 300MW floating farm in the Celtic Sea, potentially generating enough electricity for hundreds of thousands of homes.

The increase in ambition in less than five years is astonishing, and these early projects will play a key role in cutting costs and providing vital information for future entrants to the sector – but in less than 10 years’ time, they will pale in comparison to the floating windfarms that are coming.

Voting floaters

The ScotWind leases, awarded for a total of £700m to the Scottish government, vary significantly in size and cover areas around the coast. The largest, from Scottish Power Renewables, will have capacity of 3,000MW, while the smallest purely floating farm, by Falck Renewables, will have 500MW. Altogether, the floating farms could power millions of homes.

It is still far from clear what the turbines themselves will look like. Fixed-bottom turbines have developed in leaps and bounds in recent years, with industry leaders Siemens Gamesa and GE – both of which have existing or planned manufacturing plants in the UK – offering 14MW models, thanks in part to bigger rotors, enabled by improved manufacturing such as casting blades in one piece. Successful ScotWind bidders forecast that even bigger turbines will eventually top their floating structures.

The ‘floaters’ themselves are likely to develop over time. Like floating oil and gas platforms, they will be moored to the seabed, but there are different ideas of what they could look like.

Equinor outlines two main design concepts – one is a ‘spar buoy’ descending directly beneath the tower, to maintain stability with the centre of gravity beneath the surface, while the other is a triangular ‘semi-submersible’, sitting mostly out of the water but further out on either side. Floating wind is a new technology, and the next 10 years are likely to throw up some surprises.

So why are companies risking so much money on it?

Economies of scale

Just over 30 years since the installation of the Vindeby farm, Ørsted is the world’s biggest developer of offshore windfarms, and the ScotWind lease is its first floating project. Built alongside Falck Renewables and BlueFloat Energy, the 1GW farm will provide Ørsted with vital experience to develop markets elsewhere, says Hogg, who is Ørsted professor of renewable energy at Durham.

The Seawind project, planned by a collaboration between Vattenfall and Fred Olsen, also sees its ScotWind lease as a path to future success. “Although we can still secure sites that are suitable for bottom-fixed, the move is tending much more towards the scale and the capacity that floating offshore offers,” says Carolyn Heeps, head of offshore wind project development at Fred Olsen.

At 800MW, Seawind is one of the smaller leases. “If we just go a few years back, an 800MW project was a huge project, and now we are a tiny little project in the big ScotWind scheme of things,” says Esben Strandgaard Kyndesen, chief commercial officer at 1848, Fred Olsen’s technology and innovation arm.

The rapid pace of development means it is still unclear what technology will be used, with decisions expected later in the decade. Kyndesen says the plan is to install at least 15MW turbines, and maybe even up to 20MW. Floating platforms can accommodate an increase in turbine size more manageably than fixed-bottom foundations, he says, enabling upgrades – and the associated economic benefits – as technology develops.

Stormy seas

Despite securing leases to the areas above the seafloor, each of the 17 successful ScotWind applicants have extensive consenting processes to navigate in the coming years, as well as determining their grid connections and gaining planning consent.

The technology itself could throw up several significant challenges. “If you’re going to put the wind turbines on a floating body, it becomes technically more challenging and more expensive and more complex,” says Hogg.

“The oil and gas industry, and other industry, has lots of experience of building large floating structures, and keeping those floating structures stable in rough sea states,” he says. “There are technologies that exist for stabilising the structures that probably will be transferable into the offshore wind sector, but then there’s a whole range of additional challenges.”

Destined for some of the windiest areas around the British Isles, the turbines will inevitably move in the wind. Swaying high above the platforms, translational movements will move the entire structures, causing maintenance challenges.

Movement could also increase aerodynamic interactions between the turbines, as the wakes behind their blades move and interact. This will need to be managed to maximise energy yield.

There are issues around anchor design and fastening floating structures to the seabed, Hogg adds, as well as the perennial issue of cable failure before the end of turbines’ intended design lives – a particular challenge for floating turbines, which have more waterborne cable and more movement on the surface.

Steely resolve

Perhaps more concerning than the engineering challenges is strain on the supply chain. The “really aggressive” planned expansion will cause problems, says Kyndesen.

“I did a quick calculation, and if you apply 15MW per the 15GW of awards [a total of 1,000 turbines], and multiply that by a very optimistic 5,000 tonnes of steel, then you have an enormous amount of steel that needs to be produced… and that’s simply not realistic.”

He adds: “Focusing only on fabrication yards in Scotland is not solving it. We need to go back to the steel fabricators, to the plate manufacturers or the rolling mills, and get an understanding of how they envision the impact of this award.”

Despite the UK’s lead, Kyndesen suggests it looks to a country that has been slower on the uptake for a solution to the challenges ahead.

“You could just have a look to the US,” he says. “Big ambitions, big pipelines are really kickstarting the development of the supply chain… it really has spurred the development of three big steel-producing facilities in the US, just on the back of the proposed pipeline.”

Problem solving

The UK’s floating offshore industry is not resting on its laurels after the success of the ScotWind leases, however, and many projects are aiming to tackle engineering challenges and maximise profitability.

Just one week after the Crown Estate Scotland awards, the UK government announced £61m of joint government-industry funding for 11 projects developing floating wind technologies.

Led by Aberdeen’s Reflex Marine, the Javelin project will use £880,000 to develop a cone-shaped anchor to create powerful friction locks with small-diameter boreholes drilled in tough parts of the seabed. The Integrated Floating Offshore Wind Demonstrator (Infloat), led by Copenhagen Offshore Partners, will use £9.7m for a demonstration of a 15-18MW platform, including new mooring technologies and dynamic cable protection. Among other things, the £10m Sense Wind project will develop advanced monitoring technology to enable offshore predictive maintenance, while Swansea’s Marine Power Systems aims to include a 0.5MW wave-energy generator onboard its 2MW floating wind platform.

Using single platforms for multiple energy streams could make them particularly appealing. Instead of electricity, the ERM Dolphyn project will export green hydrogen from a floating Principle Power platform, using a 2MW turbine to power onboard electrolysis.

Bodies such as the Offshore Renewable Energy Catapult’s Floating Centre of Excellence are bringing developers together to drive rapid commercialisation.

“The key driver is going to be collaboration,” says Vicky O’Connor, technical manager for development in Europe at Northland, a member of the centre and a successful ScotWind bidder. “It’s probably a case of ‘we all win, or no one wins’. It won’t be quite as bespoke as fixed-bottom, where you go out individually and source, engage and order. That is a key part of the success that this floating wind market will be based on – collaboration across the board.”

Fresh wind

With so much industry focus on a relatively new technology, something even more revolutionary might come along. Hexicon’s TwinWind foundation, for example, provides space for two turbines, aligning the foundation itself – rather than the nacelle, which contains the generator and drivetrain between the blades – with the direction of the wind, and allowing for more turbines in a set area.

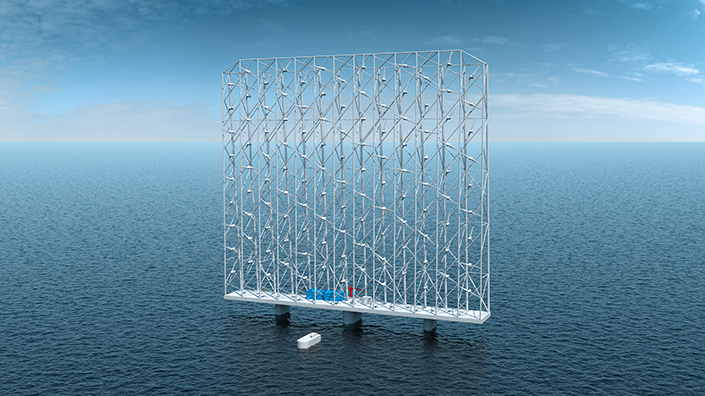

Norwegian firm Wind Catching takes that idea to even more extreme lengths with a concept that houses 120 small turbines on a giant lattice-like structure that would stand taller than the Eiffel Tower. The design could cut acreage by 80% compared to conventional tower turbines, the team claims, and would be based on a tried-and-tested semi-submersible structure used in North Sea oil and gas.

Wind Catching's radical concept houses dozens of turbines on a single scaffold (Credit: Wind Catching)

“It’s very large and very complex because of its size,” says Daniel Engelhart-Willoch, vice-president of industry and government affairs. “But the idea is to take existing technologies and concepts and combine them.

“If you look at the turbines that we’re using here, they’re much simpler structures, much simpler concepts than the big, complex 15-20MW turbines that you see from other manufacturers. We don’t pitch the blades, we stall them rather than using pitching motors. And instead of turning the individual nacelles, the turbines, we have the whole structure swivel.”

Simpler designs are likely to dominate the early commercial projects, but radical concepts could attract great interest as floating wind makes its transition from niche concern to perhaps the most dominant future form of wind energy. In the UK in particular, the ScotWind farms and a wealth of offshore experience will create a huge export potential for engineers, operators and manufacturers.

Floating “is a much bigger market potentially, and where ultimately things are going to go,” says Wharton from RenewableUK. “It’s going to be a huge global market. And if we can demonstrate that it works, and get the design engineering in the UK, that’s obviously a huge export opportunity.”

This feature appeared in Professional Engineering, Issue 2, 2022.

Want the best engineering stories delivered straight to your inbox? The Professional Engineering newsletter gives you vital updates on the most cutting-edge engineering and exciting new job opportunities. To sign up, click here.

Content published by Professional Engineering does not necessarily represent the views of the Institution of Mechanical Engineers.