Before 2019 the biggest challenge on the horizon for businesses was how to weather the Brexit storm and the ramifications of pulling out of the EU. Later that storm was further whipped up by a global pandemic that brought with it huge upheaval and uncertainty and, more recently, by inflation including the extraordinary spike in oil and gas prices. Navigating through this storm is certainly testing the resilience of companies, particularly small and medium-sized businesses.

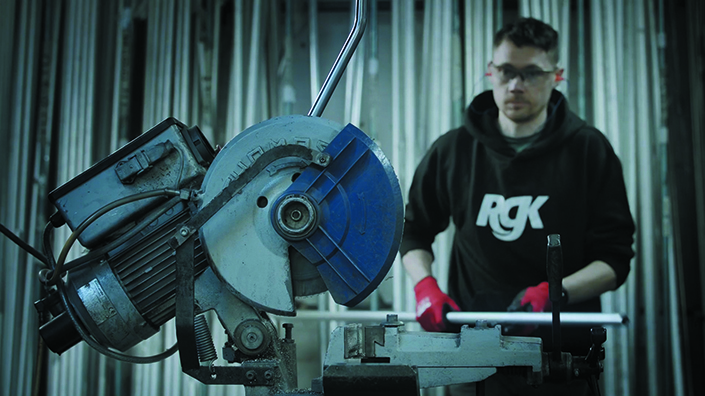

Michael Sheen, general manager at RGK Wheelchairs, says: “We’re a small business of less than 100 people producing high-end sport and daily-use made-to-measure wheelchairs at our Staffordshire factory and, generally, we’ve battled through the past few years pretty well. But, like every business, it’s that one hit after another. Looking back, Brexit and the various logistics issues it caused doesn’t seem like the biggest problem we’ve had to face at all.”

While perhaps not the biggest problem, the aftershock of Brexit is still very much being felt by RGK, which ships its products around the world. From a time of free trade, doing business in the EU has become extremely time-consuming, predominantly owing to the increased paperwork now needed to move goods in and out of Europe.

Sheen explains: “Every country in the EU has its own customs systems, and so each shipping company has had to create the paperwork and logistics process for those systems. This caused huge delays of months, not just days, which not only affected our productivity but also customer satisfaction in that warranty repairs were delayed as was the shipment of new products.

“I would certainly say that the logistics between Europe and the UK has been a huge headache, and it’s probably taken three years for it to become somewhat manageable.”

Changing course

On the other hand, Midlands-based engineering company Lontra, which is ramping up production of its high-value compressor technology, anticipated logistics issues and so chose to focus initially on exporting to the US market rather than Europe.

Steve Lindsey, founder and CEO of Lontra, says: “The reasoning is that the US makes up 26% of the world market for our type of machine and also it’s zero rated for import duty. Focusing on that market first protects us from some of the uncertainty of what is happening in Europe due to Brexit. Of course, it has meant increased investment in terms of setting up US distribution and getting the right partners on board.” But, as Lindsey says, facing challenges like this and finding ways of dealing with them is just part and parcel of being in business. While Brexit has had less of an effect on exports for Lontra it’s certainly affected supply chains, particularly the extended lead times on certain raw materials.

“But it’s not just us it affects. As long as your competitors have the same supply-chain issues then it’s back to the business challenge of how to do better than your competitors,” says Lindsey.

“We’ve certainly had to invest in a bigger purchasing and logistics department, which we are continually managing. And while there is a drive to onshore, this doesn’t necessarily bring prices down. In some cases it increases prices. But, as with deciding to focus on the US market for export, being a fairly new high-growth company gives us an advantage in that we can change strategy faster than others.”

Covid and staffing issues

At the start of 2020 when Covid hit, the biggest challenge it presented to many businesses was lockdown. It seemed that almost overnight staff had to leave their places of work and continue their jobs remotely. This was a challenge as businesses had to have the technologies in place to enable this to happen.

For some companies like RGK, this was less of a challenge because, as its staff are classified as industry key workers because it manufactures medical equipment, the business was allowed to remain operational during the early part of 2020. Some staff were furloughed but a lot remained in work. There was the expected drop in orders at the start of lockdown, which soon built up again over the ensuing months, but by far the biggest challenge Covid presented to RGK was the retention of staff.

Sheen says: “As we were allowed to stay open we got through it pretty well; we didn’t make any redundancies or staff cuts but as we were coming out the other end we experienced a high turnover of staff. It’s almost like Covid made people reassess their lives and decide that they either wanted to retire early or do something different.

“The challenge was that we had a huge influx of orders due to pent-up demand, and so we were busier than ever but we just didn’t have the staff to manage that. For us Covid was less a business issue and more a people issue,” he adds.

As a small business that doesn’t have the automated systems that a larger company might, RGK is very reliant on the skills of its people. For instance, a welder has specific skills that have been honed over many years and, when they leave, their knowledge leaves with them. Training a recruit is an investment and it takes many months for them to be anywhere near the same skill level.

“Not having the people to deliver on our orders meant our lead times just got bigger. We’ve only recently got on top of it now and have had to put strategies in place to ensure that we don’t have this training and recruitment issue in the future,” says Sheen.

Balancing act

As we emerged from the various lockdowns and the world began to open up again in 2021, there was an anticipation that life and business would “get back to normal,” only to be presented with major spikes in fuel prices. Demand for gas sky-rocketed, driving prices up. In October 2021, it was reported that the front-month Dutch TTF gas contract – a European benchmark for natural gas – achieved a new record as gas prices soared by almost 400% since the start of the year.

This global fuel crisis was further compounded in 2022 as a result of the war in Ukraine, which disrupted supplies of energy. This war also restricted the supply of many raw materials from Russia and Ukraine, which has caused a surge in prices. How do small businesses, which are already struggling, manage with these rising costs? For a lot of them, it’s a balancing act of what they can pass onto the customer in terms of raising prices and what they can’t.

Sheen says: “The cost of energy is ludicrous. We have eight vans and in the last year the cost of fuel has increased by 50%. So, whereas we’d usually pay £25,000 a year on fuel, that has gone up by an extra £12,000. And that is alongside all our suppliers putting their costs up too.

“Like many businesses, we are faced with a choice: suck it up and lower your profit or pass on the costs to your customer. It’s a difficult decision because we’re making a medical product, which is really important to people and the last thing you want to do is for less people to be able access it, but equally we have 80 staff whose jobs we have to secure. It’s a hard balance to get right and has caused many a sleepless night,” admits Sheen.

Solar solution

Manufacturer Airedale Springs of Haworth in West Yorkshire has certainly felt the rise in energy prices but with 132 solar panels on the factory roof it is able to generate some of its own electricity. Installed over a decade ago, this 30kW system paid for itself after eight years and now contributes 20% of the company’s energy requirements.

Company chairman Tim Parkinson, who has spent the past 40 years working in the family business that his grandfather founded in 1945, says: “We’ve decided on the back of continuing increases in energy to extend the system with the aim of as much as possible getting off the grid. That is a two-pronged approach. First is to increase our ability to generate more electricity using the existing and additional panels, which also has a battery back-up system. Second is to reduce our electricity use as part of improvements being made to our manufacturing processes. This is already proving successful as over the past year we have managed to reduce our energy consumption by 20%.”

.jpg?sfvrsn=f1a66511_0)

With the company’s fixed-term energy contract coming to an end in October, Parkinson hopes that the solar installation will be complete and there would be further energy reductions as a result of improvement to its processes. “Even though we’re paying more for our electricity, our actual usage will be more manageable. But we’re still predicting our energy expenditure year-on-year to increase. So it’s about trying to mitigate a bad situation rather than making money out of the process,” he explains.

“From the prices we’ve been quoted, our electricity bill will increase by £100,000 a year over what we paid in 2022. To install the solar panels will be £300,000, which is a big investment for a small business like ours, but if we can reduce that £100,000 even by 50%, the new solar system would have paid for itself in six years. So we either decide to spend £100,000 extra on electricity and do nothing or we make that investment. For us it’s a bit of a no-brainer.”

Government support

Amid all these rising costs and supply-chain disruption, it begs the question whether the government should be doing more to help. Lindsey certainly thinks so. Despite all the turbulence of the past few years, Lontra has managed to open a new manufacturing centre in Doncaster to produce its flagship product, the LP2 Blade Blower, which is a big step for the small company but was only made possible through government funding. South Yorkshire Mayoral Combined Authority is supporting this smart factory with a £7m investment through the South Yorkshire Renewal Fund, with a further £10m coming from private-sector match funding by Lontra.

Lindsey says: “Government intervention is key to driving R&D because governments underpin innovation. In its UK Innovation Strategy published in July 2021 the government claims it wants the country to be a global hub for innovation by 2035. And, while it has pledged to raise R&D spending to 2.4% of GDP by 2027, in 2019 both Germany and America spent 3.2% of GDP on R&D, so the UK is very much lagging behind.

“The UK government also cut R&D tax credits for start-ups and small firms because of fraud. If the issue is fraud, then address the fraud, don’t cut R&D because it’s R&D that drives productivity and economic growth. Good companies can weather any cost crisis but they need the government support in order to become good companies.”

Incentives to invest

Make UK, which represents manufacturers, agrees with this sentiment. In a survey published towards the end of 2022, in which it is forecast that manufacturing will contract by -3.2% in 2023, Make UK stresses that increased support from government is needed if economic prospects continue to weaken. One of these measures is rethinking recent decisions on the R&D tax credits for small businesses to avoid deterring them from investing in innovation.

As Stephen Phipson, chief executive at Make UK, says “There is no sugar-coating the outlook for next year and possibly beyond. Even for a sector as resilient as manufacturing these are remarkably challenging times which are testing even the best and most successful of companies to the limit.”

In the meantime, it’s back to business for these companies which are trying to navigate the cost crisis as best they can, which is not showing any sign of abating. On a positive note, Sheen says that the experiences of the past few years have helped to keep RGK as efficient as possible. “You have to really look at the detail and consider every penny that you’re spending. We are definitely working a lot smarter now than we were pre-Covid,” he says.

Similarly, Airedale Springs is making investments and adjusting processes to reduce energy consumption. As Parkinson says, “We’re probably heading into a recession this year, which will be my sixth over my working career. The good news is that they do eventually come to an end but to ensure you’re one of the businesses still standing you have to stay ahead of the game by investing in people and equipment.”

Want the best engineering stories delivered straight to your inbox? The Professional Engineering newsletter gives you vital updates on the most cutting-edge engineering and exciting new job opportunities. To sign up, click here.

Content published by Professional Engineering does not necessarily represent the views of the Institution of Mechanical Engineers.