As computing power has grown exponentially, the range of engineering tasks that can be carried out within the confines of a PC has grown – including the ability to test, through simulation, the viability of a design or component.

The aim is to obviate the need to build many prototypes, thereby cutting down on cost and saving time. As an example, it’s possible now to simulate vehicle crash testing to such a degree of accuracy that subsequent physical tests have similar or identical results. Scott Berkey, chief executive of Simulia, the Dassault Systèmes division responsible for simulation technology, says: “There are some situations where our customers can avoid all the prototyping; there are others where we can cut the amount of prototyping in half.”

At Dassault’s rival Autodesk, half a billion dollars have been invested in acquiring simulation technology over the last seven years, says Erwin Burth, head of simulation sales. “In the end you will need physical prototypes – but instead of making five or six you make one or two. In some areas it’s just not possible to build physical prototypes. It won’t completely go away: it will be significantly reduced.”

Ansys, which has been supplying simulation software to engineering companies since 1970, employs many specialists in fields such as finite element analysis, computational fluid dynamics (CFD), electronics and electromagnetics, and design optimisation. Around 70% of the company’s staff in Britain are engineers; of these, half are educated to PhD level, says Gary Panes, European marketing director.

The company focuses on using simulation technology at earlier stages in the design process, a phenomenon Panes describes as “simulation-driven product development”. When the term was coined a decade ago, says Panes, the concept was strictly “science fiction”. “Even within Ansys, people were sceptical,” he says. “But we’ve been nibbling away at it, and we’re seeing industries now where they truly are starting with simulation.”

In automotive, for example, it can be months before any meaningful computer-aided design is developed for a new vehicle. So OEMs are using elements from old digital designs early in the process. If these are tweaked or changed in some way, it’s possible to run simulations to see how they would perform. “CAD is a bit like a prototype: it takes time to get it right because there’s a lot of money invested in it,” says Panes. “It can absorb a lot of time if you do it from scratch and get it wrong. So the industry is looking at taking previous designs, tweaking or stretching them, and simulating how they perform so new iterations can be made.”

A similar principle applies in aviation, he says. “It’s the same with gas turbines. It takes longer to design a gas turbine than it takes to design the fuselage of an aeroplane. So when Airbus announce a new aircraft which needs a certain engine, suppliers have to question whether they can meet the spec in time. Companies are interested in having these models that allow them to play with earlier designs, to tweak to gain power or fuel efficiency. Sometimes they don’t bid because they are unsure, even at that early stage.”

At Autodesk, a similar strategy is in play on the part of the software vendor that Burth describes as “simulation-driven design”. The aim is to encourage customers to employ simulation across the range of engineering design activities. Burth claims that rival software providers Dassault, Ansys and MSC are aimed at specialists. “What we are proposing with our tools is to use them as if they have been involved in the process from the beginning. We believe that simulation makes most sense if you provide different people in the design process with the proper end tools. It’s important that engineers have access to simulation tools to come up with a better design before the final shape is decided upon,” he says.

Access to simulation can be improved by the use of cloud computing and a pay-as-you-go approach, says Burth. “Tools can be expensive: if somebody buys a CAD seat, they cannot afford to buy an additional structural analysis tool for £28,000, or a computational fluid dynamics tool for £20,000. You need to be mindful of giving people access to these tools in an affordable way.”

Panes agrees that broadening the user base for simulation tools is desirable. The idea is that computer-aided engineering (CAE) specialists and their knowledge could filter down into other areas of manufacturing. “There’s a trend that we think of as democratisation – taking high-

end simulation and applying it at more of a design engineer level. Many, these days, are happy to have some finite element analysis embedded in their CAD, and if you give them something a bit more technical they certainly shouldn’t be trying it blind – but it is possible to take them through a guided, scripted or constrained version of simulation,” he says.

As an example of this non-specialist use of simulation tools, pharmaceutical or process engineers might choose blades for a mixing tank by designing in CAD, running a basic CFD simulation, and then picking the correct design. “They are not CFD specialists, but just want to know what the correct blade is,” says Panes.

The market for CAE software remains fragmented despite an increasing level of consolidation over the past decade, says Simulia’s Berkey. “Many smart individuals have been solving pieces of the CAE problem for years,” he says. Firms tend to swallow each other up as companies look to expand their technology portfolios.

Ansys keeps a list of firms that might enhance its own offerings, and recently acquired France’s Esterel Technologies – a move that is intended to broaden its reach into the design and simulation of software systems. Panes claims that Ansys is more “selective” with its acquisitions than some others. “The dynamics of the company, the attitude of the company and its financial position have to be right. A small technology company can always be acquired, and the CAD companies do that kind of thing aggressively.”

Could a small company with an innovative technology take on the big players in the CAE market? “It’s difficult to say,” says Panes. “The challenge for a small company is to survive in the game long enough. Thankfully, Ansys has got to the point where we are independent and financially stable. We’ve set a track, and our stock price makes us a difficult proposition for anyone interested in a hostile takeover.”

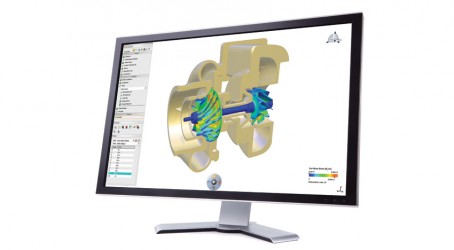

Dassault’s core simulation product, Abaqus, is the work of a company from the US that it acquired in 2005. Before the acquisition, the French firm was already working to make its Catia CAD system compatible with Abaqus, which features CFD, finite element analysis and visualisation technology. It was not just the Abaqus technology that was attractive, says Simulia vice-president Sumanth Kumar. “Abaqus had a loyal customer base – so it is the market we got, along with the technology.”

The acquisition allowed Dassault to develop the Simulia brand as part of its suite of product lifecycle management software.

For the engineers and software gurus at Abaqus, the move meant gaining access to the top tier of management among Dassault’s customer base. “If we had not done the acquisition, we would always have been a niche player. We would not have got visibility at the top level,” says Kumar. The acquisition has allowed more investment in the technology, says Simulia chief strategy officer Steven Levine, who was formerly with Abaqus. “The amount of investment that we’ve been able to put into the Abaqus suite has probably tripled since the acquisition, so there’s more features and capabilities. We’ve added CFD capabilities and electromagnetics capabilities. There’s a lot of deep relationships we were able to form as a result of being part of Dassault. We get much more executive visibility. Those relationships would have taken far more time – we didn’t have the bandwidth to address those people.”

In turn, Dassault has also benefited, believes Levine. “Prior to the acquisition, Dassault had a simulation capability, but the depth and breadth of the Abaqus software has hundreds of man-years associated with it. In principle, Dassault could have developed a system like it, but it would have taken time. Increasingly, Abaqus is part of an entire simulation and modelling environment: and that next-generation environment is something we couldn’t possibly have done without the acquisition. That infrastructure is the hallmark of what Dassault provides.”

Autodesk’s development of a simulation capability has also seen it hit the acquisition trail. The company began by buying up technology devoted to structural analysis in 2008, and followed that with software designed to simulate plastic injection moulding. “More recently, we invested in CFD code, and our latest acquisition is focused on composite technologies,” says Burth. “There’s a continuous investment going on in the simulation space.”

Would Autodesk consider developing its own simulation software? “As a vendor such as Autodesk, you always have to make up your mind whether you develop technology on your own or if you acquire proven technology,” he says. “Because of the long development cycles for simulation technology, it is tempting to go for software that is proven in the market, and this is the way we are going.”

What does the future hold for simulation? Advances in computing, the development of the cloud, and the use of simulation techniques earlier in the design process will play a part. Berkey of Simulia says: “It’s really a matter of computing capacity and high-performance computing capability, which are getting faster and more powerful.” Expect a reduction in physical prototyping, and an increase in the scope and power of simulation software to encompass mechanical, electrical and software systems within a vehicle, says Panes.

There is a softer side to the story that is of concern: the availability of enough simulation engineers, which Panes highlights as an area of particular worry. “A lot of the good engineers are knocking on retirement, and there’s not enough youngsters coming through.” It’s a well-worn theme, he acknowledges. “The larger organisations have moved beyond saying ‘this is a problem’ to asking ‘what are we going to do about it?’.”

With this skills gap in mind, perhaps it makes sense for engineering and manufacturing companies to get as much out of their existing employees as possible. “You can double or triple the output of engineers by giving them the right hardware or software, and paying attention to the process,” says Panes.

This approach has become a more realistic option as the proportional costs of carrying out simulation have shifted. “When I started out and you were an analyst, the most expensive thing in the room was the computer – the second most expensive was the software. The engineer was replaceable,” he says.

“But all that’s been inverted: for a few thousand pounds you can get a stunning piece of hardware, while software has stayed the same in numeric terms over the years, and so deflated in value. Now it’s the engineer that costs the most, at £30,000-£50,000. Some companies recognise this shift, but others are saying ‘I’m not going to buy you a big computer’. Why not? It makes absolute sense.”

Simulation offers solutions

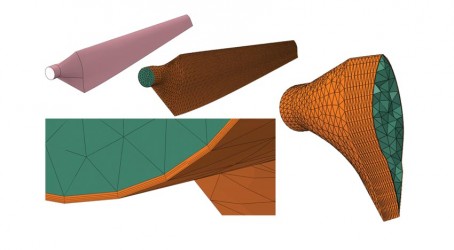

Boundary layer meshing

With Simulia Abaqus from Dassault Systèmes, wedge elements can be generated along selected boundaries of a part or a cell, and the interior filled with tetrahedral elements. Adding layers of small elements along the walls improves the analysis of boundary effects in fluid flow and heat transfer analyses.

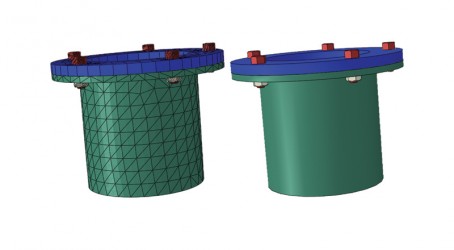

Mesh-to-geometry

Mesh parts can now be converted into geometry with Simulia Abaqus. This enhancement is useful for creating geometry from deformed meshes (for example, a stent), creating an interior acoustic cavity inside a vehicle, as well as for a number of other industry applications.